TORONTO (Reuters) – Canadian car elements supplier Martinrea International said to file fourth-area income on Thursday that has been in line with analyst expectancies and introduced “considerable” new contracts ruled by way of demand for lightweight structures. The Vaughan, Ontario-primarily based organization posted fourth-sector income of C$926.15 million ($703.23 million), ahead of the C$889.1 million consensus estimate and up 5.4 percentage over closing yr, despite low vehicle manufacturing in its key markets and demanding situations posed using trade and tariff troubles.

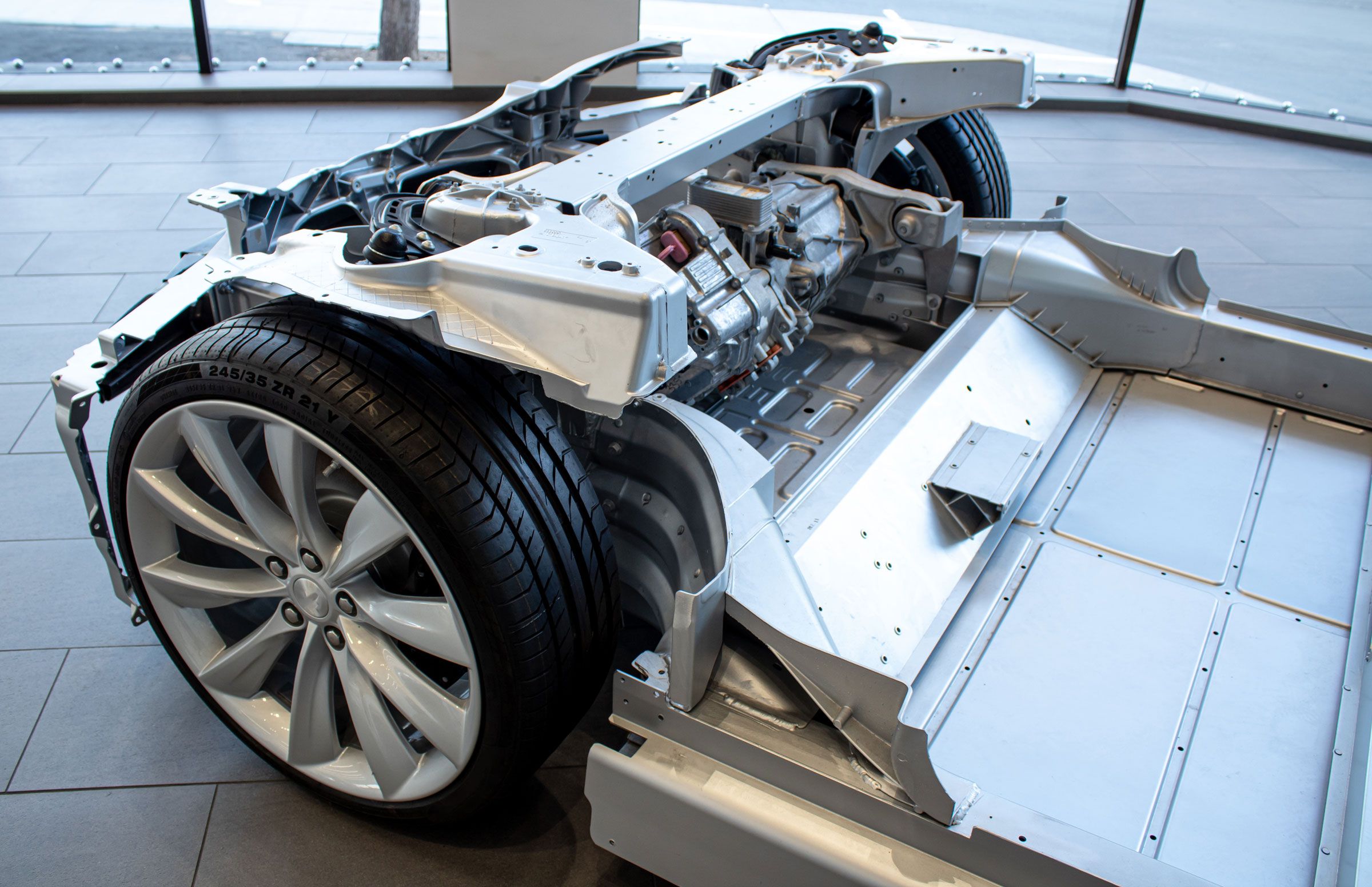

Martinrea, which produces aluminum and metal parts alongside fluid management structures, said it had won new business worth C$230 million in annualized sales at height volumes in current months. That includes C$190 million in lightweight systems for Fiat Chrysler, BMW, and Toyota, starting in 2021 and 2022. There are some other C$forty million propulsion structures, including fluid management and engine products, for Volvo, Ford, Geely, Scania, and JLR, starting mainly in 2020.

“Our lightweight answers especially attract excellent hobby,” Chief Executive Pat D’Eramo stated. “2018 become our fine 12 months ever for winning new product mandates, with approximately C$800 million in new natural commercial enterprise bulletins within the past year.”

Chairman Rob Wildeboer said the corporation expects adjusted working income margins above eight percent in 2019 and nine percent in 2020, while revenue exceeds C$4 billion. “The effect of the metal and aluminum price lists located with the aid of the U.S. And Canada isn’t always helpful to the enterprise, but we accept as true with the price lists may be removed someday this year,” Wildeboer said.

A new United States-Mexico-Canada Agreement (USMCA) was signed on Nov. 30 but should be authorized by the U.S. Congress and Canadian and Mexican legislators before becoming law. In the sector ended Dec. 31, Martinrea said adjusted net earnings of C$ forty-three .8 million, or fifty-one Canadian cents a share, compared with C$43.1 million, or 50 Canadian cents a share, in the equal duration the last yr. Net income rose nearly 17 percent to C$37.8 million.